GST-REGISTRATION

Let Grotez do the GST-REGISTRATION for you so you can solely

focus on your income rather than GST Filing

0

+

Happy Customers

0

+

Professionals

Arrange Necessary docs (Pan card Aadhar card ,Account Number,IFC code ,form 16 if any)

Step 1

Talk to consultant, and calculate the total income

Step 2

Pay tax, submit return, verify return, download acknowledgement

Step 3

Relax and wait for processing of return by department

Step 4

Overview of GST Registration

So as to cancel a few other circuitous duties and to make a solitary tax collection framework, GST was presented in India. Likewise, GST helps in the simplicity of assortment and to upgrade the proficiency of the cycle.

GST Registration is expected for the organizations whose turnover moves past Rs. 40 lakhs* available to be purchased of merchandise (Rs 20 lakhs for North Eastern – All uneven states available to be purchased of products). There has been no adjustment of as far as possible for specialist organizations. People offering types of assistance need to enlist on the off chance that their total turnover surpasses Rs.20 lakh (for typical class states) and Rs.10 lakh (for extraordinary classification states).

Inconvenience of GST Enrollment through Different Stages

Additionally, for specific organizations, GST enrollment is obligatory and if the element or a singular carries on business without getting the GST Enlistment, it will be treated as an offense under GST Act and weighty punishments will be imposed. GST Enlistment is an internet based process and GST is forced at each step of the stockpile organization to set off all the accessible tax reductions.

Each item goes through numerous stages which incorporates the acquisition of fundamental materials, fabricating, entire selling, and the retailing the items, and afterward the last deal to the buyer for utilization/use.

More or less, every labor and products go through various stages which include: – (a) Buy and assembling of Essential material, (b) entire selling and retailing the merchandise and (c) last Deal to the purchaser for Utilization. GST enlistment is expected in the accompanying cases-

Edge breaking point of total turnover surpasses.

In the event of specific organizations, Necessary Enlistment is required.

Willful Enlistment.

The GST is contained in the last cost of the multitude of merchandise/administrations before buy kills every one of the backhanded assessments that have been compulsory by the focal government and the state government ahead of time in India.

What are the Advantages of GST Enrollment?

The benefits of GST Enrollment are given cry:-

• Improves on Tax collection Administrations

GST has joined various aberrant charges under one umbrella and incorporated the Indian market.

• Decrease In Costs Of Items and Administrations

With the introduction of GST, the cascading effect of a series of VATs and taxes has been erased which has resulted in the reduction of cost of goods and services.

• Helps In Avoiding Lengthy Taxation Services

GST Enlistment helps the private ventures in keeping away from the extended tax collection administrations. As the specialist organizations with a turnover of under 20 lakhs and products supplier with a turnover of under 40 lakhs are excluded from paying the GST.

• Pointed toward Lessening Defilement And Deals Without Receipts

GST was presented with a point of lessening debasement and deals without receipts. Likewise, it helps in decreasing the requirement for little organizations to consent to different backhanded charges.

•Consistency In Tax assessment Cycle

GST Enlistment acquires consistency the tax assessment strategy and permits unified enrollment. This assists the organizations with documenting the assessment forms each quarter through a web-based process.

• Compliances Is Lesser In Number

Beforehand, there was Tank and administration charge, every one of which had its own profits and compliances. Under GST, then again, there is only one, bound together re-visitation of be documented.

• Guidelines Of Unorganized Area

In the pre-GST time, it was in many cases seen that specific ventures in India like structure development and material were to a great extent sloppy and unregulated. Under GST, nonetheless, there are arrangements for online compliances and installments, and for profiting of info credit just when the provider has acknowledged the sum. This has gotten responsibility and guideline to these enterprises.

What are the Qualification Measures for GST Enrollment?

The below mention person/entities are required to get registered under GST –

• Any business element whose total turnover in a monetary year surpasses Rs 40 lakhs (Rs 20 lakhs for exceptional classification states in GST).

• Note-This condition doesn’t make a difference in the event that the element is just managing in supply of products/administrations which are excluded under GST,

• Each substance who is enlisted under a previous law of tax assessment (i.e., Extract, Tank, Administration Expense, and so forth) requirements to get register under Merchandise and Administration Duty.

• Any element or provider managing in between state supply of products.

• Casual taxable person

• A citizen under the converse charge component

• Input administration merchant and its representative

• Online business administrator or aggregator*

• Non-Inhabitant available individual

• Specialists of a provider

• An Individual who supplies through Web based business aggregator.

• Substances who are giving web-based data, procuring data set, or recovery administrations from a spot situated external India to an individual in India, other than an enrolled available individual.

What are the Methods of GST in India?

For GST organization, a model was planned where the public authority (Focal and State) have abilities to force and gather charges through their individual regulations. The Methods of GST are given :-

• Central GST

CGST is the expense forced on the Intra State supplies of labor and products by the Focal Government. At the point when the spot of the dealer and the purchaser is in a similar state it is named as an Intra-state supply of labor and products. Here, a dealer needs to gather both CGST and SGST in which CGST stays with the Focal government while the SGST is gathered by the State government.

• State GST

SGST is the tax levied on the Intra State supplies of goods and services by the State Government.

• Integrated GST

Integrated GST is administered by the IGST Act, where the dealer needs to gather IGST from the purchaser, and the expense gathered will be split between the Focal and State Legislatures.

• Union Territory GST

Association Domain GST is material when any labor and products are utilized in the Association regions (UTs) of India and the income is gathered by the public authority of association region.

What are the Constituents of GST?

The below mention person/entities are required to get registered under GST –

• Registration Number

• Legal Name and Constitution of business

• Trade Name

• Period of validity

• Types of taxpayer

• Date of Liability

• Signature of the applicant

What is the Design of 5 Chunks Under GST?

GST systems were made by thinking about all the layman and expansion rates as a main priority. To simplify it and more straightforward, the GST was organized following the four levels structure. These four zones are given beneath, which are as per the following-

• Zero Rates

Zero rate charge implies the – nothing charge is to be applied on the products as well as administrations.

• Lower Rate

Lower charge rate decides the 5% expense rate which is applied on the CPI (Buyer Value Record) bushel and mass utilization.

• Standard Rate

Standard rate includes 12% & 18% of the tax rates.

• Higher Rates

Higher rates charge incorporates 28% of the assessment rate under GST Guideline

What Documents are Required for GST Registration?

The reports expected for the Web-based GST Enrollment changes with the kind of business. The arrangements of archives expected for GST Enlistment (in light of the sort of business) are recorded beneath:-

• For A Sole Proprietorship Business

• PAN card of the owner

• Aadhar card of the owner

• Photograph of the owner (in JPEG format,

maximum size – 100 KB)

• Bank account details*

• Address proof**

• For A Partnership Firm

• Skillet card of all accomplices (counting overseeing accomplice and approved signatory)

• Copy of partnership deed

• Photos of all of the partners and authorised signatories (in JPEG format, maximum size – 100 KB)

• Address proof of partners (Passport, driving license, Voters identity card, Aadhar card etc.)

• Aadhar card of authorised signatory

• Proof of appointment of authorized signatory

• In the case of LLP, registration certificate / Board resolution of LLP

• Bank account details*

• Address proof of principal place of business**

• For A HUF

card of all accomplices (counting overseeing accomplice and approved signatory)

• Copy of partnership deed

• Photos of all of the partners and authorised signatories (in JPEG format, maximum size – 100 KB)

• Address proof of partners (Passport, driving license, Voters identity card, Aadhar card etc.)

• Aadhar card of authorised signatory

• Proof of appointment of authorized signatory

• In the case of LLP, registration certificate / Board resolution of LLP

• Bank account details*

• Address proof of principal place of business**

What Documents are Required for GST Registration?

The archives expected for the Web-based GST Enlistment shifts with the kind of business. The arrangements of archives expected for GST Enlistment (in light of the sort of business) are recorded beneath:-

For A Sole Proprietorship Business

• Container card of the proprietor

• Aadhar card of the proprietor

• Photo of the proprietor (in JPEG design, greatest size – 100 KB)

• Financial balance details*

• Address proof**

For A Partnership Firm

• Container card of all accomplices (counting overseeing accomplice and approved signatory)

• Duplicate of organization deed

• Photo of all accomplices and approved signatories (in JPEG design, greatest size – 100 KB)

• Address evidence of accomplices (Identification, driving permit, Citizens character card, Aadhar card and so on.)

• Aadhar card of approved signatory

• Evidence of arrangement of approved signatory

• On account of LLP, enrollment authentication/Board goal of LLP

• Ledger details*

• Address proof of chief spot of business**

For A HUF

- • Skillet Card of HUF and the Identification size Photo of the Karta.

- • Id and Address Verification of Karta and Address confirmation of the business environment.

- • Financial balance Subtleties

For A Public Or Private Limited Company

• Dish card of the Organization

• Declaration of joining of Organization

• MOA and AOA of the organization.

• Personality Confirmation and address verification of all chiefs and Approved signatory of the Organization.

• Identification size photo of the chiefs and approved signatory.

• Duplicate of Board goal passed for delegating approved signatory.

• Subtleties of Financial balance opening.

• Address verification of the business environment.

What is the Procedure for GST Registration Process in India?

To effectively complete the GST enlistment, process each citizen should follow the essential cycle. The methodology for GST Enrollment is referenced beneath.

• Step – 1

The absolute initial step for GST Enlistment is to fill the web-based application, and for the equivalent, the citizen will visit the GST entrance Www.Gst.Gov.In. Likewise, the citizen (Candidate) requirements to make a username and secret phrase in the entry.

• Step-2

The Candidate need to tap the connection on the GST entryway, and snap on to the ‘New Client Login’. By tapping on ‘New Client Login’ acknowledge the window on the showed announcement structure and press ‘Proceed’ to enlist yourself for GST Enrollment.

• Step – 3

The candidate is expected to Choose ‘New Enrollment’ and Login to begin the GST enlistment system.

• Step – 4

The candidate will fill the necessary subtleties asked on the GST entryway:-

• Select ‘Citizen’ under the drop-down menu.

• Select the individual state and locale.

• Enter the subtleties of the business (Name and Skillet card).

• Give the email ID and versatile number (that should be dynamic as OTPs will be sent on the subtleties) in the particular boxes.

• Enter the Manual human test displayed on the screen and snap on ‘Continue’.

• Step – 5

The following stage in the wake of documenting the expected subtleties is to enter the OTP shipped off your email ID and versatile number in the particular boxes.

• Step – 6

Click on the ‘Continue’ button once the subtleties have been placed.

• Step – 7

A candidate will get the Transitory Reference Number (TRN) on the screen. Save the TRN for additional interaction.

Note-TRN is utilized to open PART-B in GST enlistment and to sign in to the GST enrollment application.

• Step – 8

Subsequent to getting the TRN, a candidate is expected to open the GST entrance once more and snap on ‘Register’ under the ‘Citizens’ menu.

• Step – 9

Select the ‘Impermanent Reference Number (TRN)’.

• Step – 10

Enter the TRN chose and the manual human test subtleties.

• Step – 11

When the Manual human test subtleties are placed, click on the ‘Continue’ button.

• Step – 12

A candidate will get an OTP on the email ID and enlisted portable number. Click on ‘Continue’ Button by entering the OTP got.

• Step – 13

The situation with your application will be shown on the following page. Click on the Alter symbol, referenced on the right half of the page.

• Step – 14

On the following page there will be different segments, where all pertinent subtleties are expected to be recorded alongside the essential reports.

• Step – 15

Prior to presenting the application, click on the ‘Confirmation’ page and really take a look at the statement. The underneath referenced strategies can be utilized for presenting the application:

• Electronic Check Code (EVC).

• By online sign strategy.

• In the event that the candidate is an organization, the application should be put together by utilizing the Computerized Mark Testament (DSC).

• Step – 16

When the cycle is finished, an effective consummation message will be displayed on the screen. The ARN will be sent on the versatile number and email ID enlisted by the GST Candidate.

• Step – 17

Really take a look at the situation with the ARN on the GST gateway.

What are the Penalties in Case of Non-Compliance in GST?

In Case Of Delay In Filing GSTR

• Late expense is Rs. 100 every day for each Demonstration. i.e., 100 under CGST and 100 under SGST.

• Limit of Rs. 5,000.

• No late charge on IGST.

For Not Filing GSTR

• Punishment 10% of assessment due or

• 10,000 whichever is higher.

For Committing A Fraud

• 100 percent of assessment due or

• 10,000 whichever is higher.

• Moreover, in the event of high worth misrepresentation cases additionally have prison term.

For Helping A Person To Commit Fraud

Punishment stretching out up to Rs. 25,000.

For Charging GST Rate Wrongfully

If there should be an occurrence of charging higher rate-

• Punishment 100 percent of expense due or

• 10,000, whichever is higher (if the extra GST gathered isn’t submitted with the govt).

For Not Issuing Invoice

• 100 percent of expense due or

• 10,000, whichever is higher.

Non-Registration Under GST-

• 100 percent of assessment due or

• 10,000 whichever is higher.

In Case Of Issuing Incorrect Invoice

• Punishment of Rs. 25,000

What is the Validity of GST Registration Certificate?

The legitimacy of any GST enrollment testament relies upon and contingent to the kind of citizen who is getting the certificate. It is substantial all through when the endorsement is given to a customary citizen. In such cases, it possibly negates on the off chance that it is dropped by the GST authority or gave up by the citizen himself.

However, the legitimacy is limited to a time of 90 days from the date of enrollment or for the period determined in the enlistment application, whichever is prior in cases endorsements gave for the relaxed citizen or Non-Occupant Indian (NRI) citizen. In addition, the legitimacy time frame can likewise be stretched out under the arrangements of Segment 27(1) of the GST Act by the fitting specialists.

How an Applicant will Get the GST Registration Certificate Online?

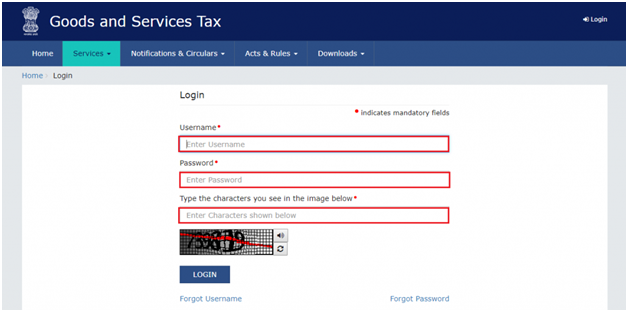

• When the ARN is created, a candidate needs to visit the GST entryway.

• Subsequently, a candidate needs to Login into his/her particular GST account, by entering the username and secret phrase made by you. Alongside that, a candidate needs to fill the right manual human test referenced in the crate and select the login button consequently.

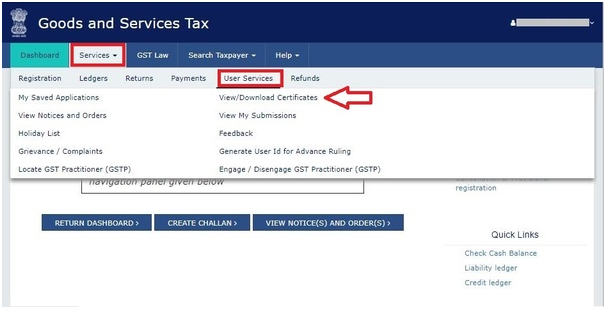

• Select “Client administrations” in the “Administrations” choice from the drop-box, where a candidate needs to choose the “View/Download Testaments” in the choices showed in the picture.

• The enlistment endorsement will consequently begin downloading when you will choose the download choice.

• For downloading the GST Declaration, a candidate needs to do is to visit the GST

- common portal https://www.gst.gov.in

From that point onward, you really want to Sign in to your GST account using the username and secret key made by you while enrolling your name for GST Enlistment in the GST Entry. Alongside, you really want to enter the manual human test accurately and select the login button a short time later.

Another page will open once the login is fruitful. From that point onward, click on the “Administrations” choice and select “Client administrations” from the drop-box. You want to pick the “View/Download Endorsements” in the choices showed in the image.

You should take note of that the Enrollment declaration will naturally begin downloading, when you select the download choice while procedures. The Enrollment endorsement will be downloaded to your gadget and can be open to see the equivalent when required. You really want to take a printout this downloaded endorsement and in like manner should show unmistakably in the spot of your business.

Grotez Procedure for GST Registration

Mercifully use the means given above to coordinate lawfully and safely a GST Enrollment and get the advantages as better-quality deals and fulfilled clients. Our Grotez specialists will be available to you for helping you with direction concerning GST Enlistment and its consistence for the smooth working of your business in India. Grotez experts will help you in arranging flawlessly essentially cost, affirming the fruitful finish of the cycle.

It is prudent that a lawyer with “Tax collection experience” should be named to overpower a considerable lot of the potential entanglements that jerk around inside GST Enlistment and to grasp the prerequisite exhaustively. The rudimentary data would be obligatory from your finish to begin the interaction. The Lawyer will start chipping away at your solicitation once all the data is given, and the installment is gotten.

Why Grotez?

Grotez is one of the stages which direction to satisfy all your legitimate and monetary prerequisites and associate you to predictable experts. Indeed, our clients are satisfied with our legitimate help! On account of our attention on improving on legitimate prerequisites, they have reliably respected us exceptionally and giving ordinary updates.

Our clients can likewise follow consistently the advancement on our foundation. On the off chance that you have any inquiries regarding the GST Enlistment process, our accomplished delegates are only a call away. Grotez will guarantee that your correspondence with experts is enchanting and consistent.

• Buy an Arrangement for Master Help

• Add Inquiries In regards to GST Enlistment

• Give Reports to Grotez Master

• Get ready Application for GST Registration+ Complete all Suitability Standards for Fundamental Screening

• Complete Procedural Activities

• Get your GST Enlistment at your Entryway Step!